fulton county ga sales tax rate 2019

Fulton county ga sales tax rate 2019 Wednesday June 8 2022 Edit. Fulton County Sheriffs Tax Sales are held on the first.

Fulton County Georgia Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

OFfice of the Tax Commissioner.

. FULTON COUNTY GEORGIA July 2019 FINANCIAL RESULTS Unaudited Cash Basis. Fultons rate inside Atlanta is 3. 50 Mobile Ave NE Atlanta GA is a multi family home that was built in 1940.

The Fulton County sales tax rate is. The Board of Commissioners and County Manager have categorized County efforts into six strategic areas. Click any locality for a full breakdown of local property taxes or visit our Georgia sales tax calculator to lookup local rates by zip code.

In the same year the murder rate. Fulton County Tax Commissioner Dr. 04-10-2022 0430 PM LM0121.

The Fulton County Georgia sales tax is 775 consisting of 400 Georgia state sales tax and 375 Fulton County local sales taxesThe local sales tax consists of a 300 county sales tax and a 075 special district sales tax used to fund transportation districts local attractions. Can someone explain to me the Fulton county - senior homestead exemptionsIve read through the. The Georgia state sales tax rate is currently.

The 2018 United States Supreme Court decision in South Dakota v. 2022 Georgia Sales Tax By County. 13 posts read 4988 times Reputation.

Effective January 1 2022 in Fulton County passing vehicle emission inspections are required for 1998 through 2019 model year gasoline-powered cars and light-duty trucks up to 8500 lbs. Some cities and local governments in Fulton County collect additional local. Fulton County Tax Commissioner Dr.

The minimum combined 2022 sales tax rate for Dalton Georgia is. The 89 sales tax rate in Atlanta consists of 4 Georgia state sales tax 3 Fulton County sales tax 15 Atlanta tax and 04 Special taxThe sales tax jurisdiction name is Atlanta Tsplost Tl. A TAX SALE IS THE SALE OF A TAX LIEN BY A GOVERNMENTAL ENTITY FOR UNPAID PROPERTY TAXES BY THE PROPERTYS OWNER.

141 Pryor Street SW. The Tax Commissioner takes the appraised value and the exemption status provided by the Board of Tax Assessors along with the millage rates set by the Board of Commissioners and other. The current total local sales tax rate in Fulton County GA is 7750.

A county-wide sales tax rate of 3 is applicable to localities in Fulton County in addition to the 4 Georgia sales tax. The December 2020 total local sales tax rate was also 7750. Ferdinand is elected by the voters of Fulton County.

The December 2020 total local sales tax rate was also 7000. The Fulton County Tax Commissioner is responsible for the collection of Property.

Property Taxes By County Interactive Map Tax Foundation

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Construction Contractors Georgia Sales And Use Tax Obligations Litwin Law

What Is The Fulton County Sales Tax The Base Rate In Georgia Is 4

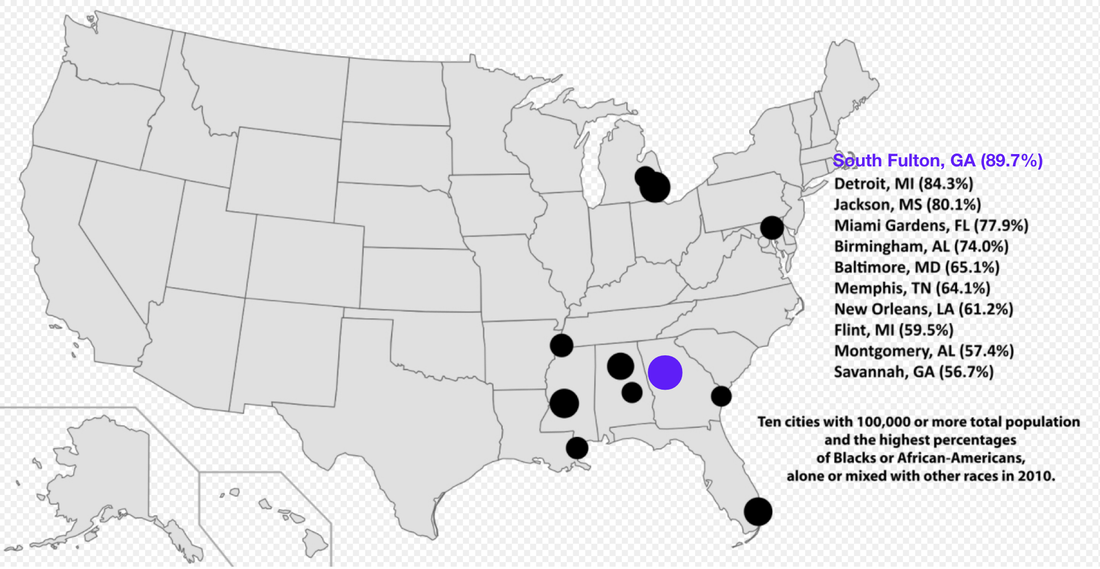

Neighborhood Categories By Race And Income Fulton And Dekalb County Download Scientific Diagram

Alabama Sales Tax Rates By City County 2022

New York Sales Tax Guide For Businesses

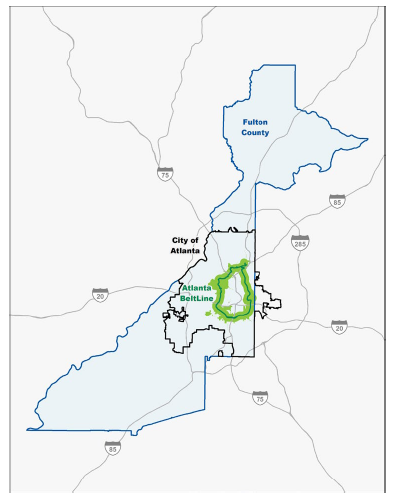

Fhwa Center For Innovative Finance Support Value Capture Case Studies Atlanta Beltline Tax Allocation District

Fulton County Rolls Out New Logo Reporter Newspapers Atlanta Intown

City Of South Fulton Ga South Fulton 101

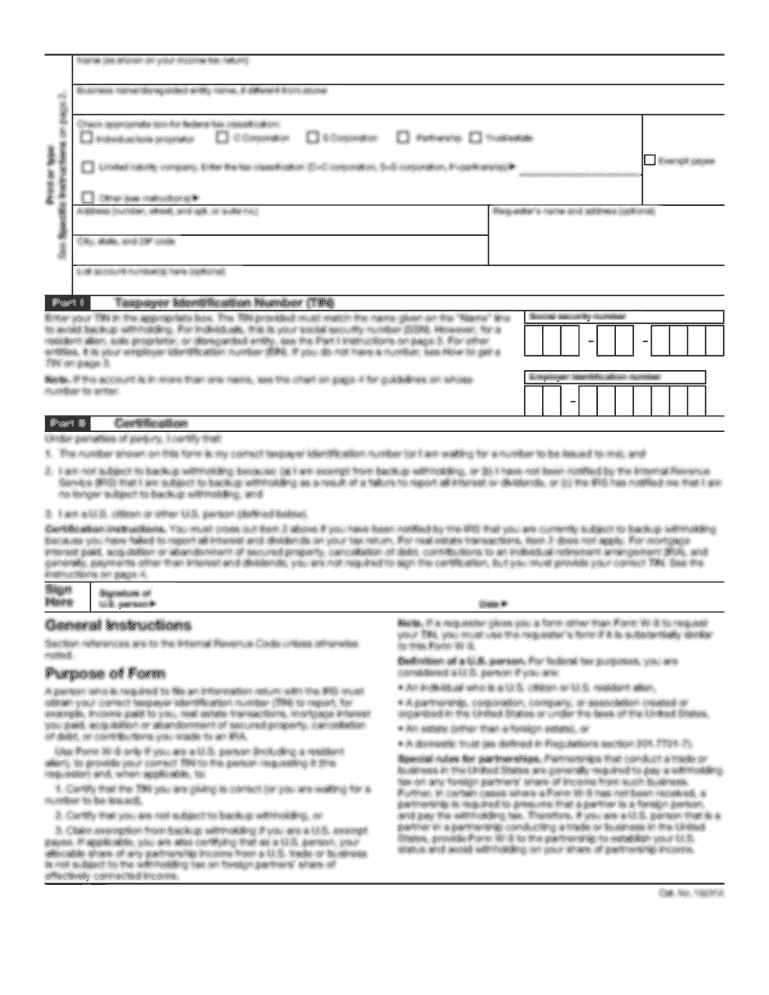

Ga Application For Basic Homestead Exemption Fulton County 2019 2022 Fill And Sign Printable Template Online Us Legal Forms

City Of Roswell Property Taxes Roswell Ga

Atlanta Property Tax Consultants Ke Andrews Fulton County Appeals

Fulton County Georgia Wikipedia

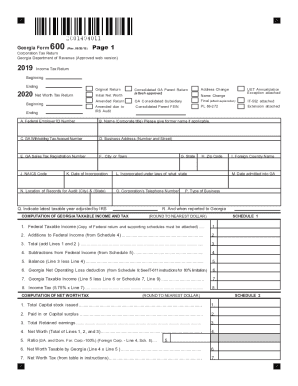

Ga Dor 600 2019 2022 Fill Out Tax Template Online

Georgia Sales Tax Guide And Calculator 2022 Taxjar

.png?width=800&name=Copy%20of%20Georgia%20Tax%20Rates%20(1).png)